Bank of England Hold Base Interest Rate at 5.25% – Why? This decision has sparked curiosity among homeowners, potential buyers, and investors. In this blog post, we will delve into the reasons behind this choice and the possible implications for the UK housing market.

Reasons Behind Holding the Interest Rate

The Bank of England’s decision to keep the interest rate at 5.25% stems from a careful analysis of the current economic climate. Inflation concerns are at the forefront of this decision. High inflation rates can erode purchasing power and destabilise the economy. By holding the interest rate steady, the Bank aims to temper consumer spending and borrowing. This approach is intended to help manage inflation without stifling economic growth.

Interest rates and Bank Rate | Bank of England

Economic stability is another critical factor influencing this decision. The UK’s economic landscape has been affected by various global and domestic factors. These include fluctuations in international markets and uncertainties surrounding Brexit. A stable interest rate is seen as a tool to provide some predictability in uncertain times.

Additionally, the Bank of England is closely monitoring labour market conditions and wage growth. Rapid increases in wages can lead to higher spending and, consequently, higher inflation. By maintaining the current interest rate, the Bank hopes to strike a balance between supporting wage growth and preventing inflation from escalating.

It’s Global, not just Local

The global economic environment also plays a significant role. Economic performance in major economies such as the US, China, and the Eurozone has an impact on the UK’s economic outlook. The Bank of England must consider these global factors to ensure its policies align with broader economic conditions.

Ultimately, the decision to hold the interest rate is a strategic choice aimed at safeguarding the UK’s economic health. It reflects the Bank of England’s commitment to monitoring and responding to a complex array of economic signals. This careful balancing act is crucial in navigating the challenges of inflation and economic stability, while keeping an eye on domestic and global economic indicators.

Impact on Mortgage Payments

Photo by Tom Rumble on Unsplash

For individuals with variable rate mortgages, the Bank of England’s decision to keep the interest rate fixed at 5.25% signals no immediate change in their monthly mortgage repayments. This steadiness provides a level of financial predictability for homeowners, allowing them to plan their finances without fearing sudden increases in interest rates.

Conversely, for prospective homebuyers or those considering refinancing their mortgage, the landscape appears somewhat different. The prevailing economic conditions, marked by the Bank’s cautious stance, may prompt lenders to adopt a more conservative approach. As a result, obtaining a mortgage could become more challenging, with banks potentially tightening their lending criteria and being hesitant to offer more competitive rates.

This scenario may particularly affect first-time buyers who are navigating the complexities of entering the housing market, as well as existing homeowners looking to secure a more favourable mortgage rate through remortgaging. The rigidity in mortgage rates, influenced by the Bank of England’s decision, underscores the importance of assessing one’s financial capacity and the cost implications of securing a mortgage at the current rate.

It is crucial for borrowers to consider their long-term financial stability, given that the interest rate environment, while stable now, is subject to change based on future economic indicators and policy decisions.

Effects on the Housing Market

The decision of the Bank of England to hold the interest rate at 5.25% brings a complex set of influences to the UK housing market. With interest rates unchanged, the initial reaction might suggest a period of stability for the housing sector. However, the broader implications of this decision reveal a nuanced impact on different market participants.

For current homeowners, the fixed interest rate may offer a sense of security. Their mortgage repayments will not increase unexpectedly, which can help with financial planning and budgeting. This stability might encourage some homeowners to consider moving up the property ladder, thereby injecting activity into the market.

Prospective buyers face a mixed scenario. The stable interest rates could be perceived as an opportune moment to secure a mortgage before any potential future rate increases. However, the cautious stance of lenders, as a response to economic conditions, could see stricter mortgage approval criteria. This hurdle may deter first-time buyers or those with less robust financial backgrounds from entering the market. Consequently, the demand for housing could experience fluctuations, influenced by the balance between these opposing forces.

Selling a House in Daventry or Rugby?

The unchanged interest rate also indirectly affects sellers. A market buoyed by stable mortgage repayments might encourage more sellers to list their properties, aiming to capture the interest of buyers seeking to take advantage of the steady rates. Yet, if the number of eligible buyers dwindles due to stringent lending criteria, sellers may find themselves facing longer sale times or the need to adjust their price expectations.

In a broader sense, the housing market’s health is closely tied to consumer confidence, which can be swayed by interest rate decisions. While the hold at 5.25% aims to manage inflation and support economic stability, its true impact on the housing market will unfold over time. Factors such as employment rates, wage growth, and overall economic performance will continue to play critical roles.

As these elements interact with the fixed interest rate, the housing market may see shifts in activity levels, pricing trends, and buyer-seller dynamics, reflecting the complex interplay of economic policies and consumer behaviour.

Savings and Investments

Photo by micheile henderson on Unsplash

For savers, the static interest rate means that the returns on savings accounts are likely to stay at their current levels. In a climate where the Bank of England has kept the base rate at 5.25%, banks typically mirror this stability by not adjusting the interest rates offered on savings products. This situation may not be ideal for individuals looking to grow their savings significantly. They may continue to see modest growth, if any, which can be a point of concern for those relying on interest income or looking to build their savings over time.

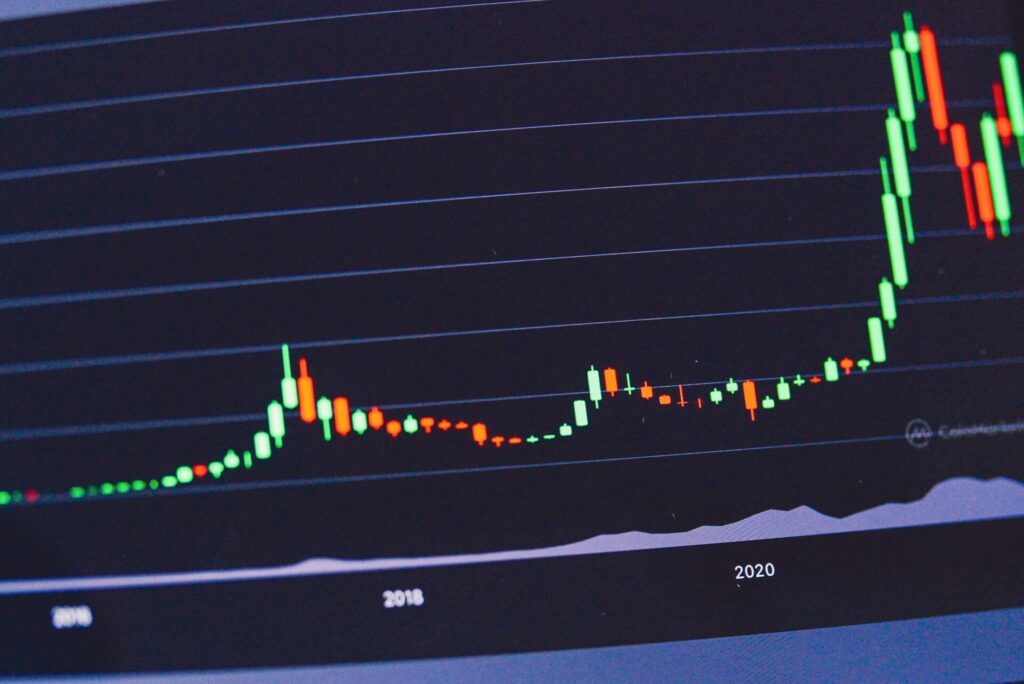

On the investment front, the decision to maintain the interest rate could have a varied impact. Investors often look at the interest rate environment as an indicator of the economic health and direction. A stable rate suggests a measure of economic stability, which can influence investment decisions. While the stock market and other investment vehicles often operate independently of direct interest rate changes, investor sentiment can be affected by such decisions. The perception of economic stability or the lack thereof can lead investors to adjust their portfolios, seeking either to capitalise on perceived opportunities or to hedge against potential risks.

Investments

However, it’s important to note that market volatility remains a factor that can significantly affect investment returns, independent of the base interest rate. Economic reports, global events, and sector-specific news can all drive market fluctuations. Investors should therefore consider a broad range of factors in their decision-making process, rather than focusing solely on the Bank of England’s interest rate decisions.

In this environment, individuals may look towards alternative savings and investment strategies. Diversification becomes key, with many considering a mix of traditional savings, stocks, bonds, and potentially higher-yield but higher-risk alternatives. This approach allows individuals to navigate the current low-yield landscape on savings while positioning themselves to take advantage of potential gains across different asset classes.

Future Predictions

Photo by Drew Beamer on Unsplash

Predicting the duration for which the Bank of England will maintain the interest rate at 5.25% is a complex task. Various factors will play crucial roles in future monetary policy decisions. Inflation rates, economic growth, and significant global events are among the primary elements that could sway the Bank’s stance on interest rates.

How do interest rates affect me and when will they come down? – BBC News

As inflation remains a pivotal concern, any notable changes could prompt a reassessment of the current rate. If inflation were to decrease significantly, the Bank might consider lowering the rate to encourage borrowing and spending, thereby stimulating economic growth. Conversely, an unexpected surge in inflation could lead to an increase in the interest rate as a measure to cool down the economy and stabilise prices.

Economic growth is another vital indicator. A robust economic recovery or sustained growth might lead to an increase in interest rates to prevent the economy from overheating. On the other hand, should the economy show signs of slowing down, maintaining or even reducing the interest rate could be seen as a way to support economic activity.

The Butterfly Effect

Global events, including geopolitical tensions, financial crises in major economies, or other international economic shocks, could also influence the Bank of England’s decisions on interest rates. Such events can have ripple effects on the UK’s economy, affecting trade, investment, and economic confidence.

Homeowners, potential buyers, and investors should remain vigilant and ready to adapt to changes. Staying informed about the broader economic context and being prepared for shifts in the interest rate landscape will be essential. Monitoring reports and forecasts from the Bank of England and economic analysts can provide valuable insights into potential future movements in interest rates.

Given these uncertainties, flexibility and a keen eye on the evolving economic environment will be key for anyone looking to make informed decisions in the housing and financial markets. The exact trajectory of interest rates remains uncertain, with adjustments likely to reflect shifts in the economic landscape and policy objectives aimed at maintaining stability and fostering growth.

Bank of England Hold Base Interest Rate at 5.25%, Why?

We hope you have enjoyed our Blog – Bank of England Hold Base Interest Rate at 5.25% – Why? Interested in knowing how this may effect you and your Home? Will buyers remain in the Market? When will the rates reduce? Call Skilton & Hogg Estate Agents in Daventry & Rugby on 01327 62425 or 01788 486100. Want us to call you? Contact Us Here.