Quarter 3 to the end of September

The recent report from TwentieCI, one the England’s largest suppliers of market data has been released and gives us a great insight as how the market has been going and where it may head. Here is a view of that Market Update and property news.

You can read it in full via this download – https://www.twentyci.co.uk/phmr/twentyci-property-homemover-report-q3-2022/

Overview

The UK property market has clearly been subdued over the 9 months. The effect of higher interest rates and cost of living means that on average, we have seen a 10% drop in activity. Different areas give slightly different readings, which we will touch on later in this piece. Interest rates are in the 5% region and look to be staying that way for the foreseeable. But, with slightly lower asking prices and the constant rise in rental values, buyers are still trying to get on the ladder and buying a house remains an attractive proposition.

Price changes, fallthroughs and withdrawals have all risen over the last quarter. However, if you compare current statistics to pre pandemic levels, there is only a 9% difference from a ‘normal’ market place. So the alarmists in the media are not always telling the whole truth.

Supply of property to the market

New instructions to the market in 2023 to date is 2.6% hight than in 2022. However, supply overall is still approx. 9% below 2019 levels. What we do see is more property to market and higher cost of borrowing. So competition for value is higher and buyers have more choice. Inevitably leading to more negotiating powers. Below is a quick overview of Q3 (July/August/September) compared to last year –

Changes in Price

Regionally, price changes have varied somewhat between the 2nd and 3rd quarters of this year. Focusing on the Daventry area, we look at the data for the East & West Midlands as we sit almost on the border. The East Midlands has faired better than the west with just a 1.4% drop in asking prices over the 6 months. The West Midlands has seen a decline of 2.4% in the same period. What we have seen in the local area is a far higher percentage of changes to asking prices. Based on Rightmove statistics, over 30% of sellers on the market have lowered the asking prices in the last three months.

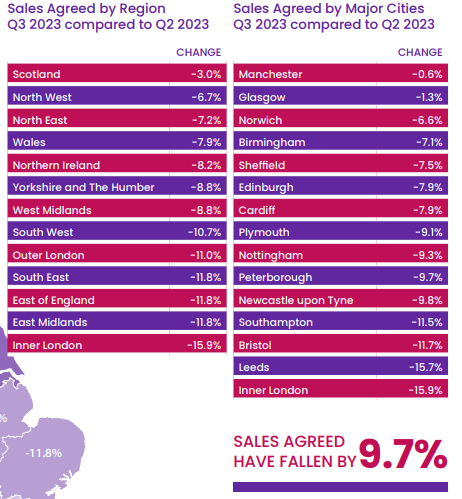

Sales Agreed Q2 to Q3

The number of property sales agreed has dropped across all regions in the UK over the last 6 months. Scotland has faired the best, inner London the worst. The East Midlands has seen 11.8% fewer sales agreed in Q3 compared to Q2. The West Midlands stands at 8.8% less. What is seen as positive is that there has been an uptrend in sales agreed in the larger towns and cities. Suggesting country living & remote working, post pandemic, is slowing.

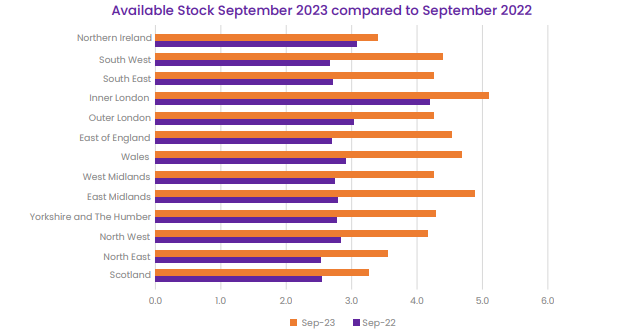

Available Property

Good news! As the Market update shows, available property to buy is clearly nearing more ‘normal’ market levels. Gone are the days of high demand, low supply which in all honesty, did create a slightly false market in terms of value. However, there are still approx. 14000 fewer properties to buy (end of Sept) compared to the same period in 2019.

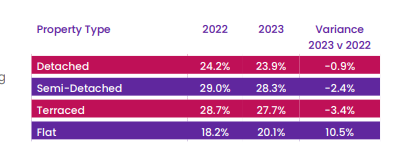

What type of property is selling?

The style or type of home being sold in the UK is evenly spread. Detached homes are just ahead in terms of numbers being sold, followed closely by Semi-detached and terraced Home. In Daventry, we do see a demand for the middle area of the property ladder which is semi-detached, followed by the market climbers buying Detached homes. Flat/apartment sales is bolstered by the city/London market but locally, there are few buy to let investors. Those that are buying, are looking for very good deals, particularly on leasehold homes.

Property News Snapshot

Mortgage Guarantee Scheme set to be extended.

The Chancellor, Jeremy Hunt is set to extend the Mortgage Guarantee Scheme in which buyers are assisted in the being able to secure a mortgage with a lower deposit level and gives mortgage lenders security and confidence.

Renters Reform Act

A lettings based snippet but which has had an effect on the selling market. Many landlords have looked to sell their homes as some see the whole process ineffective, costly and unrewarding. The most recent revision to lettings legislation is the reform act, primary centred around the abolishment of the section 21 no fault eviction notice. However, this part of the reform act could be changed or at least delayed. This is due to it potentially being biased towards the tenant. Also, UK court system not having a viable option to replace it with to protect good landlords. The vote is due soon.

Stamp Duty Cut rumours…

Just a day or two after recent election losses within the conservative party, there seems to be a small suggestion that Stam Duty relief could be looked at again. Possibly to little to late but watch this space!

Stamp Duty cut rumours return… (estateagenttoday.co.uk)

What does this Market update mean?

We hope you enjoyed reading this Market Update and property news Blog.

So, to sum up, it has been and still is a little challenging in the UK property market but only compared to a false and sometime bizarre market created post pandemic. In reality, the market is just a tad lower than the more normal market of 2019. Some argue that interest rate levels are at the correct levels bearing in mind the 6% and 7% rates of 2002 onwards which was also a growing market place. Getting back to the norm was always going to create issue within the market. However, values have proven to be strong still, buyers resilient.

In a nutshell, it isn’t going to get cheaper to buy property so now is a good time to buy if you can. If you are looking to sell your home in Daventry or the surrounding villages, do so. Values are still strong but it is imperative to ensure you place your home to the market at the right value with condition’s in mind. That means taking advise and ensuring an agent doesn’t mislead you just to secure a listing.

Here at Skilton & Hogg, we provide very detailed property reports and valuing tools supported by factual data from the Land Registry, Office of National Statistics, Rightmove, Zoopla. Also, Hometrack which is used by around 80% of the country’s mortgage lenders for valuing homes. You can see more information and obtain a FREE property report by clicking here.

If you are looking to sell you home in Daventry or the surrounding villages, click here to arrange a free no obligation valuation or call 01327 624275 and speak to David Bruckert ANAEA.

Data/Graphs courtesy of TwentieCi Consumer Intelligence.