Introduction to Spray Foam Insulation

Spray foam insulation has become a popular choice for homeowners looking to improve their property’s energy efficiency. By expanding to fill gaps and crevices, it reduces drafts and helps to lower energy bills. The material works well in sealing spaces, making homes more airtight and comfortable throughout the year. So, Why Mortgage Lenders Dislike Spray Foam Insulation?

However, the rise in its use has not gone unnoticed by mortgage lenders. They are increasingly cautious about properties insulated with spray foam. This caution stems from several concerns that can affect both homeowners and potential buyers. One significant issue is the potential impact on a property’s valuation. Improper installation can lead to various problems, making it less appealing to buyers and, in turn, less valuable.

Furthermore, spray foam insulation can complicate a home’s ventilation system. While it is excellent at sealing air leaks, it can also trap moisture if not installed correctly. This can lead to dampness, mould growth, and even structural damage, all of which are costly to fix. Maintaining proper ventilation becomes a challenge, as the insulation can hinder the natural airflow needed to keep moisture levels in check.

Lender will be reluctant to Lend

Home sellers may find that mortgage lenders are hesitant to approve loans for properties with this type of insulation. This hesitation can create obstacles during the selling process, making it essential for homeowners to be aware of these potential issues. To avoid surprises, it’s advisable to consider professional assessments of the insulation and address any concerns upfront.

In addition to mortgage issues, spray foam insulation can pose difficulties if removal is necessary. The process is labour-intensive and can be expensive, further complicating the sale of a property. Homeowners should weigh the benefits of energy savings against the potential drawbacks that might arise when it’s time to sell their home.

Understanding the broader implications of using spray foam insulation can help homeowners make more informed decisions. While it offers notable energy efficiency benefits, the possible impact on property value and mortgage approval should not be overlooked. This awareness can guide homeowners in maintaining their property’s appeal and marketability.

Concerns of Mortgage Providers

Photo by Jakub Żerdzicki on Unsplash

Mortgage lenders have several concerns about properties with spray foam insulation. One primary issue is that it can negatively affect a property’s valuation. According to the Royal Institution of Chartered Surveyors (RICS), the presence of spray foam might lower a property’s value, particularly if it is applied incorrectly. As a result, lenders might be hesitant to approve mortgages on such properties, making it difficult for homeowners to secure loans. Increasingly, mortgage lenders are rejecting properties that have spray foam insulation, posing challenges for obtaining mortgages.

In some cases, lenders may require additional assessments to determine the extent and impact of the spray foam insulation before approving a mortgage. These assessments can be costly and time-consuming, further complicating the selling process for homeowners. The potential for hidden issues with the insulation also raises concerns for lenders, as improper installation can lead to various problems, such as trapped moisture and subsequent damage to the property’s structure.

Why Mortgage Lenders Dislike Spray Foam Insulation

Another issue is the difficulty in assessing the condition of a property with spray foam insulation. The insulation can conceal problems such as roof damage or timber decay, making it harder for surveyors to conduct thorough inspections. This lack of visibility can result in higher risks for lenders, who may be unsure about the true condition of the property.

Moreover, spray foam insulation is not always installed by certified professionals, leading to varying levels of quality and compliance with building regulations. Unregulated installations increase the risk of faults and deficiencies, which can further impact a property’s value and desirability. Mortgage lenders prefer properties that have clear, documented proof of compliance with relevant standards to minimise their risk.

In summary, the potential for valuation issues, hidden defects, and the variable quality of installations are key reasons why mortgage lenders approach spray foam insulation with caution. This cautious approach can significantly affect homeowners’ ability to secure financing and, ultimately, sell their properties.

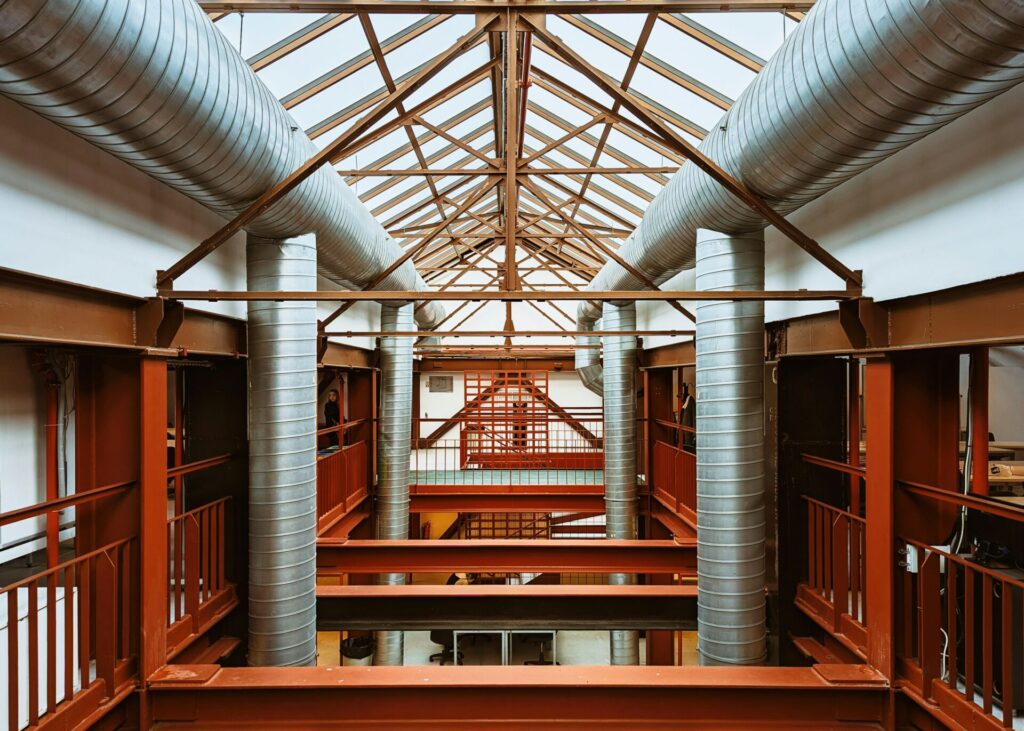

Issues with Ventilation and Moisture

Photo by Vadim Babenko on Unsplash

Spray foam insulation, while effective at sealing gaps, can introduce significant challenges in managing ventilation and moisture within a home. When not installed correctly, it can trap moisture, leading to damp conditions that foster mould growth and potentially cause structural damage. These issues are not only costly to address but can also impact the overall comfort and health of the home environment.

Proper ventilation is crucial for maintaining a balanced indoor climate and preventing moisture-related problems. Spray foam insulation can disrupt the natural airflow needed to regulate humidity levels. Without adequate ventilation, moisture can accumulate, resulting in condensation and, eventually, mould and mildew. Over time, this can compromise the structural integrity of the building materials, such as wood and plaster, and lead to expensive repairs.

Why Mortgage Lenders Dislike Spray Foam Insulation

Another concern is that the airtight nature of spray foam insulation can hinder the escape of harmful indoor pollutants. These can include volatile organic compounds (VOCs), which are emitted from household products and materials. In a well-ventilated home, these pollutants are typically dispersed and reduced to safe levels. However, with restricted airflow, they can build up to concentrations that may affect indoor air quality and occupant health.

Ventilation is Key

To mitigate these issues, it is essential to ensure that spray foam insulation is installed by qualified professionals who adhere to best practices and building regulations. Proper installation should include consideration for maintaining adequate ventilation and moisture control. Additionally, homeowners should be vigilant about monitoring their home’s humidity levels and addressing any signs of moisture problems promptly.

In some cases, it may be necessary to incorporate additional ventilation systems, such as mechanical ventilation with heat recovery (MVHR), to balance the airtight environment created by spray foam insulation. These systems can help maintain healthy indoor air quality by providing a continuous exchange of stale indoor air with fresh outdoor air, thereby controlling moisture levels and reducing the risk of mould growth.

Addressing these potential ventilation and moisture challenges proactively can help homeowners preserve their property’s condition and value while enjoying the energy efficiency benefits of spray foam insulation.

Advice for Home Sellers

Photo by Erik Mclean on Unsplash

If you’re planning to sell a home with spray foam insulation, it’s vital to address potential concerns upfront. Be transparent with prospective buyers about the insulation and its effects on property value and mortgage approval. Providing professional assessments or inspections can help reassure buyers about the home’s condition.

If it becomes necessary to remove the spray foam insulation, be aware of the associated costs. The cost to remove spray foam insulation from a three-bedroom detached house’s roof is estimated at £3,200, or £40 per square metre, according to Checkatrade.

It’s also wise to seek advice from estate agents familiar with the local market, such as Skilton & Hogg Estate Agent. They can offer guidance on how spray foam insulation may impact your selling process and suggest strategies to mitigate any issues. Highlighting any energy efficiency benefits of the insulation might appeal to eco-conscious buyers, but be prepared to discuss any potential drawbacks as well.

Avoid where possible, but ensure paperwork is in order if you do!

For homes with spray foam insulation, maintaining proper documentation is crucial. Ensure you have records of the installation, including the installer’s credentials and any compliance with building regulations. This information can be valuable to buyers and their mortgage providers, helping to ease concerns and facilitate smoother transactions.

Additionally, consider alternative solutions that might enhance your property’s appeal without compromising its value or mortgageability. Exploring options such as traditional insulation materials or adding mechanical ventilation systems can address some of the issues associated with spray foam insulation, potentially making your home more attractive to buyers.

Taking these proactive measures can help streamline the selling process and maintain the desirability of your property.

Summary and Final Thoughts

Spray foam insulation offers energy efficiency but presents challenges for those looking to sell their homes. Mortgage lenders often view properties with this type of insulation with caution, primarily due to concerns about property valuation and potential hidden defects. These issues can make obtaining a mortgage more difficult, complicating the selling process for homeowners.

The problems associated with spray foam insulation often stem from ventilation and moisture control. Improper installation can lead to trapped moisture, which can cause dampness and structural damage. These issues not only affect the property’s condition but also its marketability. Proper documentation and professional assessments can help alleviate some concerns, but they may not completely mitigate the apprehension of lenders and buyers.

Removal can be Expensive

If removal of the insulation becomes necessary, it is important to be prepared for the costs and labour involved. While this can be a significant expense, it might be a worthwhile investment to make the property more appealing to potential buyers and their mortgage providers. Additionally, considering alternative insulation methods or enhancing ventilation systems can offer a balanced approach, maintaining energy efficiency without the drawbacks of spray foam insulation.

Engaging with knowledgeable estate agents can provide valuable insights into navigating these challenges. They can offer strategies to highlight the benefits of your home’s insulation while addressing potential drawbacks. This balanced approach can help maintain your property’s appeal and facilitate a smoother transaction.

Ultimately, being well-informed and proactive in addressing the issues related to spray foam insulation can help homeowners sell their properties more effectively. By considering both the benefits and potential challenges, you can make decisions that enhance your home’s marketability and value.

Why Mortgage Lenders Dislike Spray Foam Insulation

We hope this has helped you. Do you need anymore advice? Are you looking to sell your home? For a personal, experienced and honest service call Skilton & Hogg Estate Agents today on 01327 624275 or 01788 486100. Or, click here to contact us or book a FREE Property Valuation.